DRAFT LONG-TERM PLAN 2024-2034

Takingthenextsteps

Our 10 year plan

Mahere Tekau Tau 2024-2034

He mihi

Ko Te Awa Kairangi he pou herenga iwi, he pou herenga waka.

Here mai ko te kei o tō waka ki te tumu herenga waka o ngā pae mounga kua whakatūtūria nei e te hikuroa o Ngake Mai i Tararua ki Remutaka ki Pūrehurehu, ki Pōkai Mangumangu, ki Pareraho, ki Tirohanga, ki Tukutuku, ki Puke Tirotiro, ki Pukeariki, e whakamarumarutia nei Te Tatau o Te Pō a Ngāti Te Whiti, a Ngāti Tāwhirikura, ki Pukeatua, te tuahu tapu o Te Kāhui Mounga i te wā i a Māui ki te whakapuare i te wahanui o Te Ika Whakarau a Kutikuti Pekapeka.

I ahu mai i Te Wai Mānga, i a Rua Tupua, i a Rua Tawhito, Ko Ngake, ko Whātaitai. Ka timu ngā tai o Te Wai Mānga, ka pari mai ko Te Whanganui a Tara e pōkarekare mai ana.

Ka tū a Pukeatua ki runga i ngā wai e kato ana, i a Awamutu, i a Waiwhetū, kei reira a Arohanui ki te Tangata a Ngāti Puketapu, a Te Matehou, a Ngāti Hāmua e tū ana, tae noa atu rā ki ngā wai tuku kiri o te pūaha o te awa o Te Awa Kairangi.

Koia hoki te puna i heke mai ai he tangata. E kore e mimiti tēnei puna, ka koropupū, ka koropupū. Ko Te Awa Kairangi e rere iho mai ana i hōna pūtakenga i Pukemoumou i te paemounga o Tararua ki runga i hēnei whenua, ki runga i tēnei kāinga, hei āhuru mōwai ngā iwi.

Te Awa Kairangi is a rallying point for the many people and the many tribal affiliations that have made it their home.

Bind yourself to the many mountains of this place that were born from the lashing tail of Ngake. From Tararua to Remutaka, to Pūrehurehu, to Pōkai Mangumangu, to Pareraho, to Tirohanga, to Tukutuku, to Puke Tirotiro, to Pukeariki, to Te Korokoro o Te Mana which stands atop Te Tatau o Te Pō of Ngāti Te Whiti and Ngāti Tāwhirikura, to Pukeatua, the sacred altar of the Mountain Clan in the time of Māui.

It was here that the two ancient tūpuna, Ngake and Whātaitai, were summoned from the depths of the fresh water lake, tasked with prising open the mouth of the great fish.

It is Pukeatua that stands above the waters of Awamutu and Waiwhetū, the home of Arohanui ki te Tangata of Ngāti Puketapu, Te Matehou, and Ngāti Hāmua, flowing out to the life giving waters at the mouth of Te Awa Kairangi.

This is the spring that gives life to the people. This spring which will never be diminished, it will continue to flow, it will continue to flourish. Te Awa Kairangi that flows down from its source at Pukemoumou in the Tararua ranges and over these lands as a sheltering haven for the people.

Contents – Te Reo Māori and English

Will be in full merged version

Message from the Mayor and Chief Executive

Kia ora,Welcome to our Long-Term Plan 2024-2034

Te Awa Kairangi ki Tai Lower Hutt is a growing city with dynamic and diverse communities.

We are home to thousands of businesses and innovators who drive our economy. We have a spectacular coastline, a beautiful river that flows through our city and many green spaces for everyone to enjoy. It’s easy to see why more and more people are choosing to call Lower Hutt home.

We want to do more to ensure that our city is a place where everyone can thrive. We’re working hard to achieve this through the initiatives outlined in our proposed plans which are set out in this 10 Year Plan.

As our city grows there are challenges we need to plan for and opportunities we need to make the most of. Inflation and the rising cost of living are impacting all of us. At the same time, our Council is dealing with a backlog of historic underinvestment in our key infrastructure – shown in our ageing pipes and the risk of future water shortages.

Through our plans we need to strike the right balance between the investment needed and the cost impact on people. Fixing our pipes, seeking feedback on residential water meters, and investing in other water infrastructure are our top priorities. These drive much of the proposed rates increase set out in this draft 10 Year Plan.

We know that more investment is required in our three waters network and that even the proposed $1.6 billion investment will not get us entirely to where we need to be. We’ve balanced affordability for our ratepayers with the need for investment. We are working with central government and colleagues across the region for a better way of delivering water services and to secure investment to ensure they are fit for purpose.

We are continuing the futureproofing of our city through transport and resilience projects including Te Wai Takamori o Te Awa Kairangi (RiverLink), Eastern Hutt Road, and Tupua Horo Nuku (Eastern Bays shared path). Prioritising these projects ensures our city is a safe place where everyone can thrive for decades to come.

This 10 Year Plan has been very challenging to put together. We’ve gone through the budget line-byline to find savings, identify revenue opportunities and made spending cuts before coming up with our proposals. We are not willing to put off the investment that our city sorely needs, nor are we willing to make significant cuts to our core services.

We’ve had to make some difficult calls and after rigorous work we have made $35 million in savings across the board. We’ve also had to ensure we’re prioritising the investment needed to bring critical water and roading infrastructure up to scratch. Thank you for your contribution to this plan that helps us build a connected, resilient and inclusive city where all of our people thrive.

Jo Miller

Partnership with Mana Whenua and Mātawaka

First and foremost is our relationship with Mana Whenua, who have historic and territorial rights in Te Awa Kairangi ki Tai Lower Hutt. The tribal history and legends are based in the lands they have occupied over generations, and the land provides sustenance for the people and enables hospitality for guests.

Mana Whenua interests are represented by five iwi (tribal) organisations and two Mana Whenua marae in Te Awa Kairangi Lower Hutt – Te Tatau o Te Pō and Waiwhetū Marae.

Partnership with Mana Whenua

Council has Tākai Here (Memoranda of Partnership) with the four iwi organisations representing Mana Whenua and iwi Māori in Te Awa Kairangi Lower Hutt.

These take a covenant approach, reflect iwi strategic plans, and align with Council and iwi aspirations.

More information about Mana Whenua partnerships can be found here

Welcome to our draft 10 Year Plan

2024 - 2034

Taking thenext steps (sub header)

Every three years, Hutt City Council prepares a 10 Year Plan that sets out the initiatives and services we plan to fund over the following 10 years. Council adopted our last 10 Year Plan in 2021, and this year it’s time for us to review and adopt a new 10 Year Plan.

Over the last three years we have successfully focussed on getting the basics right. Now we are asking you to help us take the next steps in making Te Awa Kairangi Lower Hutt a great place to live now and into the future.

In 2021 it was clear there was a need and a strong desire from the community to invest in the basics like water infrastructure, our transport network, housing, and resilience measures due to the changing climate and increasing severe weather events. Now Council is taking the next steps on our journey. We remain focused on our goal of providing fit for purpose infrastructure enabling a more connected, resilient, and inclusive city where all of our people can thrive.

The economic conditions have become much more challenging since 2021. Te Awa Kairangi Lower Hutt is dealing with the consequences of historic underinvestment in ageing infrastructure, record population growth and more frequent weather events that are disrupting the city and affecting the roading network. In addition, we are facing increasing costs across the board including higher interest rates, inflation and extra insurance costs.

As you read the updated 10 Year Plan, you will see we have outlined the key infrastructure projects that will help Council address the challenges the community is facing. We are still focussed on resilience and investing in core water and transport infrastructure but know that these will take time to fix properly. We have also looked closely at our other activities and services in the 10-year budget with the economic climate and cost of living in mind.

Upgrading our city’s infrastructure remains a key area of focus, in particular our water services. Council’s Infrastructure Strategy shows how we are taking a proactive approach to addressing our core issues:

• Council will focus on fixing the parts of the water network that are in poor condition by repairing known leaks and increasing the number of kilometres of pipes that are renewed.

• The Seaview wastewater treatment plant is nearing the end of its serviceable life, and we need to renew a number of the critical systems at the facility.

• We are looking at ways to manage the increasing demand for water through initiatives such as universal smart meters and building the resilience of our reservoir network.

• Completing the construction of Tupua Horo Nuku (Eastern Bays Shared Path) will provide more protection for the road out to Eastbourne from the ocean and extreme weather events.

• Improving the resilience of our roading infrastructure by finishing the improvements to Eastern Hutt Road and making good progress on a new multi-modal transport corridor connecting Gracefield and State Highway 2 (the Cross Valley Connection project).

• Making progress on the construction of Te Wai Takamori o Te Awa Kairangi (RiverLink) to provide protection from floods and further revitalise our city centre, improving public transport and addressing congestion.

Alongside investment in infrastructure, a priority is to focus on community wellbeing and supporting people to identify and be proud of where they live. This 10 Year Plan shows that we are taking steps to provide flexible, high-quality spaces and places where people can connect and access services and activities, including hubs and libraries, community halls, pools, and other facilities.

Our financial management remains strong, and our Financial Strategy continues to focus on achieving a balanced budget over the long-term. Like many other councils, we know there are financial challenges ahead and that we must continue to act prudently on behalf of ratepayers to balance wellbeing and ratepayer expectations.

A key focus of the 10 Year Plan is taking the next steps in facing the pressures of a growing population, ageing infrastructure and the impacts of a changing climate. We must do this while also striking a balance between planned rates

increases and including funding to progressing key projects and avoiding significant service reductions.

[the following is to be updated after consultation]

With financial sustainability and affordability front of mind Council is proposing an increase of 16.9% (after growth) in the total amount of rates revenue we collect for 2024/25 in order to fund the approved projects. Around 450% of this will go towards investment in infrastructure for water services and the remaining funds will cover costs for all the other services including roading, parks, community facilities, rubbish and recycling.

This rates increase equates on average to $10.83 per week per residential household.

How to read this plan

We have a wide range of responsibilities and provides a variety of services to the community of Te Awa Kairangi ki Tai Lower Hutt. To guide our activities and management of our finances and ratepayers’ money responsibly, we work to detailed plans. This 10 Year Plan is also known as the Long-Term Plan.

This 10-Year Plan is aimed at providing a long-term perspective over Council’s:

• activities and decision making,

• activities Council plans to undertake,

• the cost of delivering these activities and how they will be paid for.

This 10 Year Plan was shaped through a comprehensive process of engagement, planning, consultation, and decision making which will continue through the life of the plan. It outlines Council’s vision for the future and contains plans to achieve that vision over time. It also highlights the challenges and opportunities facing Council and our strategy to meet these over the next 10 years in each activity area.

In addition to setting Council’s direction, this 10 Year Plan sets out the basis for monitoring and evaluation, so we can report to the community on progress.

Here’s a quickrundown of theCouncil planning and reporting cycle:

• The 10 Year Plan sets out the plans for Te Awa Kairangi Lower Hutt over the following decade and outlines key projects and budgets for that period. The first year of the 10 Year Plan also serves as the Annual Plan for that year.

• In the two years following a 10-year plan, Council produces an Annual Plan each year.

In both the 10 Year Plan and Annual Plans we set goals across different activity areas to make sure Council is always striving to best serve the community. In Council’s Annual Report, we compare the goals we set with how we performed that year. This document is then audited by the Office of the Auditor General.

Challenges we are all facing

It’s important to understand the challenges we are facing in this 10 Year Plan. This is one of our most challenging plans due to the growing population, challenging economic environment, changing climate, managing our assets and dealing with past under investment in our water infrastructure. All these factors play a part in how we plan to take the next steps for our city.

Agrowing population

The current population of Te Awa Kairangi ki Tai Lower Hutt is about 113,000. We’re expecting this figure to reach 125,000 by 2033, and 137,000 in 2043. [could show this in a simple graph?] Our population is also ageing. Rates of projected population growth are highest at ages 50 and over, while the share of the population aged over 70 is expected to rise from 11% to 14% over the next 30 years. Population growth of this scale is putting huge pressure on our supply of houses and infrastructure like pipes and roads.

What we’re doing: Council is working in partnership with the Government, community organisations and the private sector to prepare for population growth. We want to deliver a city that is thriving and meets the needs of diverse businesses, residents, and visitors. We are proposing to continue our policy which requires developers of new houses to contribute to the cost of growthrelated infrastructure such as the cost of the pipes and roads to help support our increasing population.

Achallenging economic environment

Since setting our last 10 Year Plan in 2021, circumstances have changed a lot, with many factors creating the new economic environment.

Council knows the community is facing increasing cost burdens that are having a significant impact on day-to-day living. Council is also faced with economic pressures such as high inflation, the higher cost of borrowing due to increased interest rates, increasing insurance costs, and higher construction and resourcing costs. We need to strike the right balance between these cost pressures and the importance of investing in our city’s infrastructure. Simply put, Council is facing much higher costs and the need to balance the budget is essential.

What we’re doing: Council is carefully considering the rating impact on our community who are affected by the rising cost of living. This means reviewing project budgets and working hard to find savings in our operating costs.

Looking after ageing infrastructure

Council is dealing with the consequences of historic underinvestment in our ageing infrastructure. When this is combined with record population growth, higher costs across the board and more frequent severe weather events, it presents us with some key questions to answer. We are also looking closely at providing sustainable transport choices to ease traffic congestion in the city. This means that water services, transport options and our resilience measures are all in the spotlight even more with increasing demand and much higher levels of investment required. We also have a significant deferred work programme which needs to be dealt with in the years beyond this 10 Year Plan. This will be difficult to do with our current funding mechanisms.

What we’re doing: For this 10 Year Plan, we’re taking the next steps with a clear commitment and strong focus on improving infrastructure. Most of our investment is going towards water and transport as well as projects focused on adapting to a changing climate. All this work is essential in building strong foundations for our future.

Weathering thechangein climate

Communities around the country are feeling the impact of more frequent and severe weather events due to the changing climate. With much of our population living on a large flood plain, we know that Te Awa Kairangi ki Tai Lower Hutt is especially susceptible to the risk of flooding and landslides.

What we’re doing: Te Wai Takamori o Te Awa Kairangi (RiverLink) is a major project we are undertaking in partnership with Greater Wellington Regional Council, Mana Whenua and central government. As well as improving flood protection the project will develop better walking, cycling, and public transport connections in central Te Awa Kairangi ki Tai Lower Hutt and help to revitalise our city centre.

Council wants to avoid increasing debt on this project. We’re considering ways to lower costs by reducing some parts of the project and looking at different ways of doing things, as well as Investigating other funding sources.

We’re also exploring extending due dates over the life of the project so we can spread the costs more evenly across a longer period of time, reducing the impact on our balance sheet and our ratepayers.

Managingourassets

Past under-investment in many of our facilities means significant work is required over the next 10 years. One of the financialchallenges we’re facing is the future affordabilityof our community facilities, parksand reserves.

At the same time, there is increasing demand from our growing population for new activities. We must ensure we can continue to meet the needs of communities while not increasing the burden on ratepayers.

What we’re doing: Council has reviewed leases, licenses and hirefees in line with our Revenue and Financing Policyto ensure they reflect the true cost of assets and strike a fairbalancefor users and non-users.

Council also plans to look at when and how buildings and spaces are being used and whether they could provide better service to our community, alongside the existing users.

OurStrategy

Our vision is to make Te Awa Kairangi kiTai Lower Hutt city a place where everyone thrives. To do this, we need a plan to get there. Our plan centres around three key priority areas and four waysto support how we deliver them.

We’re working towards:

• Providing future-fit infrastructure

• Enabling a liveable city and vibrant neighbourhoods

• Supporting and enhancing the environment

We’re taking the next steps: [icons to support each]

• In partnership with our communities

• In a way that isfinancially sustainable

• Taking climate changeinto account

• All while promoting the wellbeing of allpeople

Long term financial planning

Budget savings of almost $35 million have been made and incorporated into this 10 Year Plan. Given the importance of the decisions that needed to be made we’ve been through all our budgets line by line, and looked at each project in detail to be sure that we’re doing everything we can to make savings, reduce costs and make good decisions for the long-term success of Te Awa Kairangi ki Tai Lower Hutt.

Council continues to invest in a programme of work called Go Digital, which will help increase efficiency and keep costs down. Go Digital is modernising our operational systems, the way we work, and how we engage with the Public. As you will see in this document, Council has taken steps to organise some projects differently, been flexible where possible and delayed some of our transport initiatives, such as the strengthening of the Cuba Street Overbridge, and postponed some renewals work until we’re in a better position to start them.

Two factors are central to our planning:

• Ensuring our long-term financial sustainability, and

• Carefully considering rates charges that are as affordable as possible for our community.

All project and investment decisions are based on the financial approach outlined in our Financial and Infrastructure strategies. You can read the full strategies in Section 3 of this 10 Year Plan.

Hereis whereyour rates will bespent over thenext 10 years:

Conclusion

We know all Councils are facing some big challenges in the coming years. If we achieve what we set out to do in this 10 Year Plan, then our infrastructure will have progressed to be fit for purpose and resilient against the impacts of the changing climate, and will meet the needs of a growing population. In addition, our facilities and services will support the wellbeing of the community. We will have taken the right steps in aiming to have a much more resilient and future proofed city and one where people are proud to live in.

To take the next steps

The purpose of a 10 Year Plan is to answer the question, “What will our city look like in 10 years as a result of this 10 Year Plan?” As we have seen, this plan outlines how we are going to take the next steps to make Te Awa Kairangi ki Tai Lower Hutt better by fixing things like roads and pipes, managing urban growth and housing intensification, improving our facilities and services to meet community needs, and building resilience to combat the impact of our changing climate. To help us make decisions and prioritise projects, we have developed a framework that identifies our priorities and focus areas for long-term planning and investment decisions. The priorities are like the building blocks of the plan –everything we do in the plan should fit with at least one of these priorities. These priorities are based on clear direction from the elected members to support a connected, resilient and inclusive city where all people thrive.

The framework is a guide for the work we will do in the next decade. By using this tool, we’re able to ensure our decisions are strategy-led, streamlined, and consistent. If projects don’t align, we are able to ask why – is it an activity that sits outside our priorities? Or is it something that simply isn’t a priority in the next 10 years?

The fundamental principle of our strategic approach is to promotethewellbeing of all people in Te Awa Kairangi ki Tai Lower Hutt, focusing on the social, economic, environmental, and cultural wellbeing of the community. The main priorities are: [icons to illustrate]

What wewill do:

• Providefuture-fit infrastructure: Making sure the city has good quality and future-ready pipes and roads.

• Enable a liveablecity andvibrant neighbourhoods: Prioritising a high quality of life, green spaces, and community places.

• Support and enhancetheenvironment: Working to support and protect the natural environment and biodiversity. And howwewill do it:

• In partnership: Collaborating with different groups, organisations and businesses to achieve our goals.

• With the changing climate in mind: Considering the changing climate in all decisions and actions.

• Being financially sustainable: Managing money responsibly.

The Principle: Promoting the wellbeing of all people

For Te Awa Kairangi ki Tai Lower Hutt to thrive, neighbourhoods and communities need to be safe, connected, healthy, inclusive, and resilient. Neighbourhoods and communities give us a sense of place and purpose. Council’s role is to support and enable neighbourhoods and communities to thrive.

Council works alongside communities to facilitate and support community-led initiatives and find local solutions to local issues. We use community hui listen to the specific issues and work on problems with groups and agencies across the city.

Our contribution to enhancing Māori wellbeing

We remain dedicated to activating Te Tiriti o Waitangi, working to deepen understanding and navigate pathways to implement and apply the articles within Te Awa Kairangi ki Tai Lower Hutt. The Māori population in the city is steadily expanding, underscoring the need for well-defined aspirations and objectives aimed at enhancing health, education, and employment opportunities for Māori.

Tākai Here (Memoranda of Partnership) serve as ongoing guidance on how we should engage in partnerships with mana and integrity. Collaborating with Mana Whenua enhances our capacity to fulfil Council’s commitment to nurturing and supporting all Māori and Mātāwaka residing in Te Awa Kairangi ki Tai Lower Hutt.

Mana Whenua, Mātāwaka, and Marae organise annual events like Te Rā o te Raukura, that actively promote and champion health, wellbeing, and whānau. Council is committed to offering support to ensure the success of these events, as they provide Māori and our wider population with engagement opportunities.

Priority 1: Future-fit infrastructure

Our infrastructure supports Te Awa Kairangi ki Tai Lower Hutt to be a liveable city where all people thrive: the social, economic, and cultural wellbeing of our community is sustained, and the health and safety of people, property and the environment is protected.

We’re facing some big financial challenges as we re-prioritise projects in this 10year plan. To meet all our aspirations we need a financial strategy that allows us to invest in key areas that will get our city moving- and meet the requirements of a growing population. We must get to a more financially sustainable footing. We also need to ensure that growth pays for growth. This means allocating costs and charges where they fall.

With a growing population we also face some significant housing challenges. We are supporting partnerships to build more warm, dry, environmentally friendly, and healthy homes for our people to live in. By prioritising investment in upgrading and building new infrastructure, we are creating a strong foundation for sustainable growth that will help meet our aim of protecting and enhancing our environment. We consider it prudent to invest now, to avoid large costs in the future or seeing our infrastructure falling behind the needs of the growing population.

Priority 2: Enabling a liveable city and vibrant neighbourhoods

Over the next 10 years we want to take the next steps in creating a liveable city that promotes a high quality of life for everyone. Easy access to green spaces and community places is an important part of this. Our neighbourhood hubs are places to gather and connect and are central to creating vibrant communities. A lack of affordable housing stock is an issue, and our inner city has a high proportion of renters which is set to increase further. The city centre does not have dense housing in comparison to other parts of our city and we have little social housing in the centre. We know that the quality of our housing stock is low in some areas (e.g. Epuni and Melling), where some experience more mould and dampness than in other areas. Over half of our city’s dwellings are more than 50 years old.

Making sure all our residents live in thriving neighbourhoods and have access to good quality housing remains a key priority for this 10-Year Plan.

Priority 3: Supporting and enhancing the environment

We want to support our natural environment, enhance biodiversity, and enable our community to connect with natural spaces. To achieve this our strategies and plans highlight the need for reserve management practices that respond to the changing climate, and resilient against storms and flooding.

The Council’s draft District Plan proposes a range of provisions to address stormwater runoff, this includes water-sensitive urban design rainwater storage tanks and greywater systems for all new residential development to both store and allow for the reuse of water. Our Urban Development team is preparing a spatial plan that will provide a strategic vision and guidance for the future development of our city, outlining goals and objectives for sustainable growth.

We realise that we cannot solve our environmental challenges alone. That is why we are partnering with other councils to implement programmes like the Wellington Region Waste Management and Minimisation Plan 2023-2029. This will create pathways for everyone in the region to work together to care for our resources

Through activities like our kerbside rubbish and recycling service and the Silverstream Landfill, we already take a joined-up approach to managing solid waste.

Over the next 10 years, we want to take the next steps in our recycling programme alongside our partner councils to include kerbside waste collection for food and green organics (FOGO). In doing this, we will relieve the pressure on our landfills across the region.

Our finances at a glance

The budget for this 10 Year Plan has been developed to ensure the delivery of the priorities and progress the investment in basic infrastructure.

There are three key challenges which need to be managed:

Alongside these three challenges, there is uncertainty around legislative reforms and potentially higher compliance requirements that need to be catered for through this 10 Year Plan. The guiding principles for the financial strategy include:

• achieving intergenerational equity, by spreading the costs between present and future ratepayers

• prudent borrowing levels

• achieving a balanced operating budget and ensuring that every day costs are paid for from everyday income

• careful consideration of the affordability of rates charges

• delivering services effectively and efficiently

• strengthening the financial position in the long term

• maintaining principleof “growth pays for growth”

Check out the full Financial Strategy. <link>

Councils are limited in the ways they can generate revenue to cover their costs. Rates are our main source of revenue. Water services (38%) and transport (18%) make up more than half of our operating spend. Although savings were applied to budgets through previous plans, high costs and inflation are being identified across all our activities, which are outstripping savings made.

The cost of borrowing has also increased significantly and is allocated to service areas where incurred.

Council has agreed to go out to the community on a proposed 16.9% rates revenue increase after growth for the year starting on 1 July 2024. On an averagely priced residential home this would equate to around $10.83 more per week in rates.

Council has noted that this 10-year plan has been one of our most challenging due to the cost-of-living crisis, escalating costs, and the need to invest in our infrastructure after decades of under investment.

Through our plans we need to strike the right balance between the investment needed and the cost impact on people. Fixing our pipes and other water infrastructure is our top priority and driving much of the proposed rates increase set out in this draft 10-year plan.

Savings, spending cuts and revenueopportunities

As part of developing the draft LTP proposals for Council we have needed to complete a savings exercise to ease the burden on our ratepayers. We’ve dialled up some activities (like investment in water infrastructure) and dialled down others which are not considered core or priorities at this time. This means we expect there to be some changes to current activities and service levels. These activities have provided great value to the community, however, in the current environment we need to put our resource and budget into other areas.

We’ve gone through the budget line-by-line to find savings, revenue opportunities and propose spending cuts which have informed the proposals included in the draft plan. These equate to $35M over the next 10 years and these have an ongoing effect to reduce the rating impact on ratepayers.

We’ve applied financial principles to our approach for savings and investment. This includes the principle that growth pays for growth (i.e. allocating costs and charges where they fall).

Savings have been made through withdrawal and delaying of some programmes and reducing some services, together with some increases to fees and charges like parking and leases. Some examples of savings include:

• Disestablish Te Wao clubhouse based in Naenae and shift to delivering this Kaupapa through programming and staff based at Neighbourhood Hubs. Disestablish the Safe

• City Ambassador programme – in the current environment we have made the decision to prioritise funding and resource to CCTV services and other safety initiatives.

• Stopping our funding of Hutt Science – We are working with House of Science to identify other sponsors and sustainable funding for this service.

• Continuing our shift towards more community led activity at our facilities, including sports and activities operating at Walter Nash Centre

• Reducing funding for the E Tu Trust – public art will be funded through other existing mechanisms

• Reducing funding for Matariki – in line with our community-led approach, we will offer funding to third parties to host these events

There are savings in other areas such as Mayor’s Taskforce for Jobs (from Year 2 of LTP), exiting Business Central etc.

We’ll continue to implement efficiencies and look for different ways to increase our income which can reduce the rates burden. Refer to <link> for more information about the savings.

Capital Investment and funding

To address growing demands for core infrastructure assets, Council plans to spend $2.6 billion over the next ten years. 62% of this spend is in water services and 21% on transport. This investment level is a significant increase of $1.2 billion compared to the previous 10 Year Plan in 2021, largely due to the need to support investment in a growing city, address the infrastructure deficit with ageing assets and the impact of significant cost escalations due to a challenging economic environment

This significant capital investment will be funded largely by borrowings with some funding from development contributions and central government.

Wellington Water Ltd and Council have been building capacity and capability over the last few years to improve delivery performance. The significant increase in the capital programme, particularly in water services, carries a level of uncertainty and there are risks associated with this. Any delays to our

programme may result in not meeting planned levels of service which will impact our community or result in greater costs in the long term.

Asset management

Infrastructure deteriorates as it ages, increasing the likelihood of failures and service disruption. These failures increase maintenance, operations and customer service costs. Renewing infrastructure that is reaching, or is at, the end of its life reduces the risk of service interruptions and minimises maintenance costs. We are not able to fully fund renewals of all assets during this 10 year plan due to the significant rates increases that would require. While the focus of this plan is for 10 years, there are significant challenges beyond the period of this plan related to the deferred investment and how this will be funded.

Threewaters – drinking water, stormwater and wastewater

Following advice from Wellington Water Limited, this 10 Year Plan includes a significantly higher capital budget for the maintenance, operations and renewal of water assets. This budget is based on what is affordable, even though we know it is less than half of the 30km per year of pipe renewal rate that Wellington Water recommended. This budget will be used for the most urgent jobs and projects. The budgeted spend is expected to result in improvements to the water network over the 10 years and maintain the current levels of service.

Transport

The Integrated Transport Strategy developed in 2022 identified some challenges for the transport network. This 10 Year Plan takes a step towards addressing some of these issues and is expected to improve the overall condition of the transport network over the 10 years. Funding constraints have also had an impact on the planned investment. Government priorities are not yet finalised and further changes may be required in future plans to reflect these priorities.

Abalanced operating budget – everyday costs arepaid for from everyday income

A guiding principle of Council’s Financial Strategy is the importance of having a balanced operating budget. This means that projected operating revenue over the lifetime of this 10 Year Plan is set at a level that’s sufficient to meet projected operating expenses. This ensures that ratepayers are contributing an appropriate amount towards the cost of the services they receive or are able to access, i.e. ‘everyday costs are paid for from everyday income’. This plan projects deficits until 2028-29 when a balanced operating budget position is expected to be achieved, which effectively means we are borrowing to offset the funding shortfall before then.

The projected operating budget provides a realistic balance between managing the pressures on ratepayers and ensuring Council remains financially sustainable into the future.

Borrowings

In August 2023, the Standard & Poors Global Ratings Agency affirmed Council’s AA credit rating, but adjusted the outlook from stable to negative. This reflects the risks associated with higher borrowings due to increased capital investment. To help fund the cost of infrastructure, Council’s Financial Strategy for the upcoming 10 years reflects increases to other funding sources such as development and financial contributions, higher rates revenue, and fees and charges to help fund the cost of infrastructure. After taking other funding sources into account, increased borrowings are largely funding the capital investment programme. Net debt of $0.3 billion at 30 June 2023 is projected to increase to a peak of just over $1 billion in 2029-30.

The projected debt profile is outlined in the graph also highlights the much higher borrowing levels compared to the Annual Plan 2023-2024. The proposed programme fully utilises the debt headroom capacity available whilst ensuring debt is managed prudently within the limits set. Rates

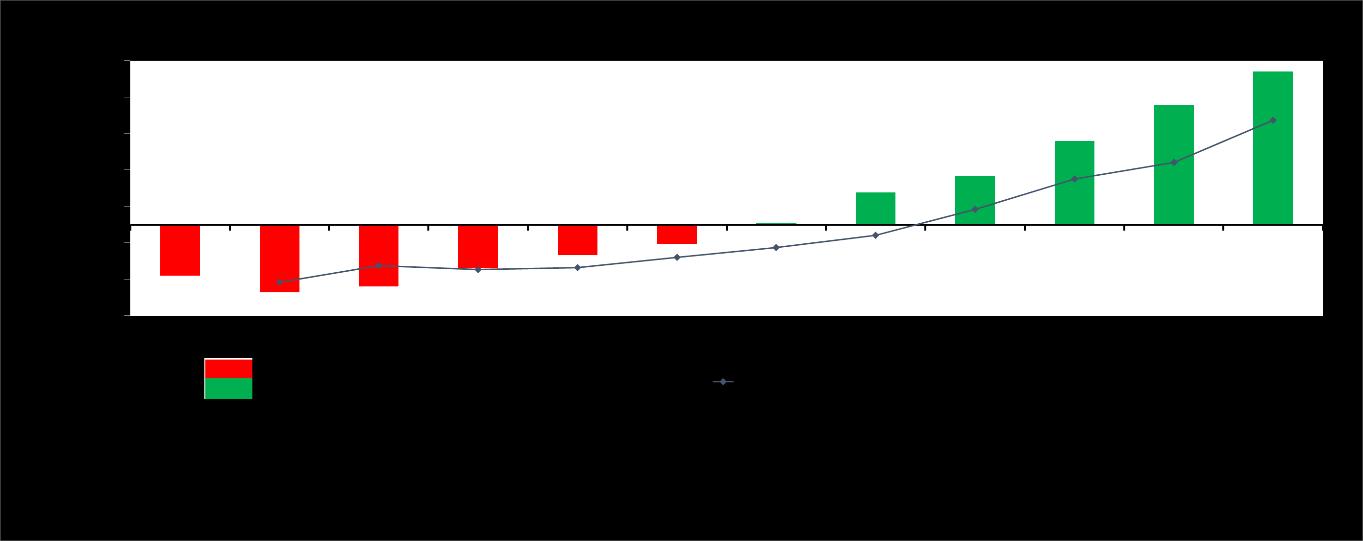

The graph below outlines the rates revenue increases over the 10-year period in the plan.

The examples below show how a range of properties are affected by the proposed rates increase for 2024/25.

Debt and revenue sources are increasing in this 10 Year Plan, however, the levels of service are still at risk due to cost pressures that may exceed the assumptions around inflation. We are doing everything we can to mitigate the risks.

Check out the full Strategy and project list in our supporting documents <link>

Further information can be found in this 10 Year Plan. See:

• Financial Strategy <link>

• Infrastructure Strategy <link>

• Revenue and Financing Policy <link>

• Funding Impact Statement Including Rates<link>

What you said about this 10 Year

Plan

[to be updated following the results of consultation]

Introduction to the Statements of Service Performance Chapter

Taking the next steps (sub header if Gusto need, depending on design)

Welcome to the chapter about Service Performance Reporting in Hutt City Council's 10 Year Plan. Here, we'll illustrate how we make decisions and work towards making our community better in areas like the local economy, the environment, and social and culture activities in Te Awa Kairangi ki Tai Lower Hutt.

We measure our Statement of Service performance through key performance reporting. In 2023, Council undertook a comprehensive review of all Key Performance Indicators (KPIs), resulting in some adjustments that will be explained in this chapter.

The KPIs establish a direct alignment between a performance measurement (what we do) and the outcomes we seek for the city (why we do it).

Developed in collaboration with service delivery managers, these indicators align with Council's strategic priorities and were agreed by our elected members. The KPIs help facilitate performance improvement through regular assessments and are measured on a regular basis. The annual Resident’s Satisfaction Survey plays an important role in monitoring the quality of services and facilities that Council provides.

In 2010, the Government introduced a series of mandatory non-financial performance measures that all local authorities must monitor and report to for their communities. The aim is to enable residents to actively participate in discussions about levels of service for their areas and to lift involvement in the decision-making processes of local authorities.

You can find more information about the mandatory non-financial performance measures here – link.

How to read this Chapter

One of our main jobs at Council is to make decisions that are fair and helpful for both current and future generations who live here now and those who will live here in the future. We carefully pick performance measures that match the goals we have for our services and show how well we're doing.

This involves looking closely at what we do, making sure our service goals match our criteria for success, and getting input from the community when we develop documents such as their 10 Year Plan, the Annual Plan and Resident Satisfaction Surveys.

The performance dashboard at the start of each section gives you a quick look at how well our services are performed. The indicators help us track progress outlined in this 10 Year Plan.

By going through this section with an understanding of how:

• we make decisions,

• follow the rules,

• measure our performance, you should get a good idea of how our Council looks at and shares information about its services.

Introduction to Environmental Wellbeing Section

TeAwa Kairangi ki Tai Lower Hutt Environmental Wellbeing

Ensuring communities have access to quality green spaces and clean, safe waterways is important for enhancing everyone’s health and wellbeing. Green spaces provide areas for physical activity, relaxation, and social interactions, contributing to reduced stress and improved mental wellbeing. Clean waterways not only ensure a safe water supply but also contribute to a healthier ecosystem that supports the diverse flora and fauna we enjoy in the city. In this way, safeguarding the environment is synonymous with safeguarding community health.

Taking the next steps over the next 10 years, our focus will be on making positive changes to keep our freshwater healthy and removing storm and wastewater safely and efficiently. We know there are challenges with using too much water now, so we want to change how we use and manage it. Planned changes in the Government’s Natural Resources Plan will help transform how we utilise water, emphasising less water use, smarter practices, and a promise to keep our freshwater healthy for generations.

Our strategic approach to managing our water infrastructure is outlined in Council’s Infrastructure Strategy contained in this 10 Year Plan. The Infrastructure Strategy tells the story of Council’s stewardship approach to the management of the core infrastructure in Te Awa Kairangi ki Tai Lower Hutt and to meeting the challenges our infrastructure faces.

Some of our other projects outlined in this 10 Year Plan are designed to have positive impacts on our urban environment. For instance, by enabling and encouraging the installation of electric vehicle (EV) charging stations, we are playing a role in growing the necessary infrastructure to encourage greater use of EVs. This, in turn, contributes to reduced air pollution and a cleaner, healthier environment. It exemplifies our commitment to fostering sustainability and wellbeing through targeted initiatives that align with the region’s broader environmental goals.

Environmental Wellbeing

Dashboard

Infographics

Average residential electricity consumption

• January 2023 – 433 kWh (Electricity Authority)

• June 2023 – 720 kWh (Electricity Authority)

New solar and wind renewable energy connections in the Wellington Region from April 2022-31 March 2023

• Sun – 123 (Electricity Authority)

• Wind – 0 (Electricity Authority)

Total number of solar and wind renewable energy connections in the Wellington Region at April 2023

• Sun – 4000 (Electricity Authority)

• Wind – 17 (Electricity Authority)

Residents perceptions of problems (Percentage who agreed with problem2023)

• Traffic congestion – 79% (Quality of life survey)

• Air pollution – 23% (Quality of life survey)

• Noise pollution – 44% (Quality of life survey)

• Water pollution – 64% (Quality of life survey)

Stories for Environmental Wellbeing

Why we are proposing to invest in water meters

We're working with Wellington Water and other Councils across the region towards making sure we have enough water for everyone. Water meters are a key component in helping to manage our water better. They help us use water wisely, reduce risks, and save money. Our goal is to be efficient with our natural water resources. Meters not only track water use but also help create a smarter and more sustainable water supply. Since freshwater is a limited resource, we want to use water wisely to avoid problems and secure a healthy future for our water sources.

Our main aim is to make sure customers have sufficient water, especially during hot summer days, while also keeping costs in check. Sustainability, for us, means using water wisely, making supply systems better, and taking care of rivers and aquifers.

Our journey to water security involves three steps:

• reducing leaks,

• using water wisely,

• getting ready for future needs.

This plan not only helps to save water but also encourages smart water use through metering and helps us better prepare for our water needs throughout the summer. By working on all these things together, we make sure our water supply system is strong, and our water future is positive and sustainable.

Smart meters are one way to help us reach our goal of using water more wisely. They give customers data to manage water use and enable the tracking of leaks faster. Smart meters go beyond just saving money – they help us use water efficiently, fit into smart networks, and move towards a future where our community leads in responsible water use.

New waste plan approved

We have approved a plan to transition our city and the Wellington region over the next six years and beyond to an economy where we process and reuse materials in a sustainable or environmentally friendly way. The Wellington Region Waste Management and Minimisation Plan 2023-2029 creates a pathway for everyone in the region to work together to care for our resources – for less waste and a greater place.

We are joining with the rest of Wellington region’s councils to implement this plan. Some region-wide goals include:

• Ensuring the availability of construction and demolition waste processing and recovery by 2026.

• Providing organic processing systems by 2029.

• Adding five new resource recovery locations to the existing network by 2030.

Our action plan includes measures designed to help the city shift from just managing waste to focusing on reducing, reusing, and recycling. These actions include:

• Assisting local businesses with waste minimisation practices by offering free waste audits, presentations and supporting solutions.

• Supporting the development of regional resource recovery networks to minimise waste. This could include options for managing and processing organic waste, construction and demolition waste, biosolids, materials recovery facilities, and a region-wide resource recovery network.

• Advocating for better waste solutions to central government and other national bodies of influence.

Ngā puna wai | Water supply

Statements of ServicePerformance

What wedo

Ensuring the consistent and secure access to safe drinking water is an important concern for our community. To achieve this, Council’s committed to providing a sustainable, high-quality water supply for both domestic and commercial needs. Our ongoing efforts involve close monitoring of water quality and undertaking necessary maintenance and upgrades to meet the required service standards.

The Greater Wellington Regional Council oversees the extraction, treatment, and bulk water supply to feed the city's water supply system.

Why wedo it

By delivering water that is of high quality and affordable, Council actively contributes to several crucial activities:

• Enhancing the overall health of the community

• Ensuring community safety, particularly through the water supply system's firefighting capabilities

• Supporting industrial and residential development initiatives

Significant negativeeffects and mitigation

Possible adverse impacts encompass the reduction of watercourses (such as rivers and streams) due to water extraction rates and the decline of habitats influenced by the upgrading and replacement of three waters infrastructure. Extraction is carefully regulated to minimise adverse effects to acceptable levels. Our efforts contribute to managing water demand, thus reducing the necessity to seek new water sources

Key Performance Indicators

Watersupply PerformanceMeasure

Wewanttoensureourcommunityhas accessto asafe,clean,reliablewatersupply: The extent to which thewater supply will comply with part 4 of the New Zealand drinking water standards and the drinking water quality assurance rules (bacteria and protozoal compliance criteria)

Number of complaints received about water clarity, taste, odour, pressure, flow and continuity of supply per 1,000 connections.

Wherethelocalauthorityattends acalloutinresponsetoafaultorunplannedinterruptiontoits networkedreticulationsystem,thefollowingmedianresponsetimes aremeasured:

Attendance for urgent callouts: from the time the local authority receives notification to the time service personnel reach the site

Resolution of urgent callouts: from the time the local authority receives notification to the time service personnel confirm resolution of the fault or interruption

Attendance for non-urgent callouts: from the time the local authority receives notification to the time service personnel reach the site

Resolution of non-urgent callouts: from the time the local authority receives notification to the time service personnel confirm resolution of the fault or interruption

Quarterly ≤ 20 working days ≤ 20 working days

Weneedtoensurewehavea sustainablewatersupply forthefuture:

Capital Projects Water supply

ProspectiveStatement of ComprehensiveRevenueand Expense

Water supply

Explanations of differences between the10Year Plan 2024-2034 and the equivalent years of theAnnual Plan 2023-24 – Water supply

Revenue – Water supply

Revenue has increased by $43 million largely due to changes to fees for water set to recover higher bulk water costs and changes to the assumed development contributions revenue recovery aligned to the proposed capital programme and Development and Financial Contributions policy.

Expenditure – Water supply

Expenditure has increased by $151 million and is driven by higher operating cost budgets for maintenance and operations as per Wellington Water Limited advice, bulk water cost increases, as well as higher interest and depreciation costs linked to increased capital investment.

Capital – Water supply

Capital expenditure has increased by $166 million based on the higher investment as advised by Wellington Water Limited. Some key changes are cost increases for the reservoirs, partly driven by growth, water meters and additional funding allocated for renewal projects.

Waiparu | Wastewater

Statements of ServicePerformance

What WeDo

Council plays a crucial role in the community's wellbeing by collecting, treating, and responsibly disposing of wastewater. This service supports the growth and development of our city while ensuring the health of our residents and the protection of the environment.

We operate an extensive pipe network, and efficiently manage the flow of household and commercial effluent to the Seaview Wastewater Treatment Plant before the treated effluent is discharged into Cook Strait at the Pencarrow Outfall.

Why WeDo It

By providing a reliable and responsible wastewater solution, we contribute to the development of our community and uphold the highest standards of public health and environmental protection.

This activity aligns with our commitment to fostering a thriving, sustainable city that prioritises the wellbeing of both residents and the natural environment.

Significant negativeeffects and mitigation

The release of odours, overflows, and the deterioration of watercourses due to overflows are potential significant adverse effects. Odor control systems have been installed in sections of the wastewater infrastructure where odour issues have been noted. Reports of odours are monitored via the Council's Request for Service system and reports from the wastewater system maintenance and operations contractor. Areas affected by overflows are gradually being upgraded using a combination of approaches. Upgrading occurs through the asset renewal program, which involves replacing each wastewater pipeline as it reaches the end of its useful life, and the asset development program, which considers long-term demand projections for the wastewater

Key PerformanceIndicators

Wastewater

Itiscriticalourcommunityisnotexposedto anyhealthorenvironmentalrisks associatedwith wastewater.Weprovideasafe,reliable,qualitywastewaternetwork: Dry weather wastewater overflows per 1,000 connections

Wheretheterritorialauthorityattendstosewerageoverflowsresultingfrom ablockageorother faultintheterritorialauthority’sseweragesystem,thefollowingmedianresponsetimes are measured:

from the time the territorial authority receives notification to the time service personnel reach the site

Resolution time: from the time the territorial authority receives notification to the time service personnel confirm resolution of the blockage or other fault

Capital Projects - Wastewater

ProspectiveStatement of ComprehensiveRevenueand Expense – Wastewater

Explanations of differences between the10-year plan 2024-2034 and the equivalent years of theAnnual Plan 2023-24 - Wastewater

Revenue - Wastewater

Revenue has increased by $36 million largely due to changes to operating subsidy from Upper Hutt City Council for the higher costs of shared services for the activity, and changes to the assumed development contributions recovery aligned to the proposed capital programme and Development and Financial Contributions policy.

Expenditure- Wastewater

Expenditure has increased by $127 million and is driven by higher operating cost budgets for maintenance and operations as advised by Wellington Water Limited as well as higher interest and depreciation costs linked to the increased capital investment.

Capital - Wastewater

Capital expenditure has increased by $347 million based on the higher investment as advised by Wellington Water Limited. Some key changes are to the timing and costs for the Seaview Wastewater Treatment Plant, cost increases for the Petone Collecting sewer upgrade and additional funding allocated for other renewal projects.

Waiāwhā | Stormwater

Statements of Service Performance

What wedo

Everyone is feeling the effects of a changing climate. Council is focussed on controlling stormwater to keep people safe and minimise property damage during extreme weather events.

Through the provision of a comprehensive stormwater drainage pipe network, we effectively manage surface water run-off, offering flood protection and control.

Why wedo it

Controlling stormwater is an important step in safeguarding the wellbeing of the community. Council’s objective is to create a resilient and safe environment by managing stormwater effectively.

By doing this, we also protect people, property and the environment, while managing costs responsibly for the benefit of the community.

Significant negativeeffects and mitigation

The release of pollutants into watercourses via stormwater and flooding when the stormwater system exceeds capacity are potentially significant adverse impacts. To mitigate these, pollution prevention programs, road cleaning initiatives, and debris pits installed in most stormwater system inlets help reduce the entry of contaminants, supported by our monitoring efforts. The stormwater system is engineered to standards commensurate with risk levels at various locations, comparable to those in other New Zealand cities. Additionally, we collaborate with the Greater Wellington Regional Council regarding flooding issues related to watercourses under their management.

Key PerformanceIndicators

Stormwater

Wewanttoensureourcommunitycanenjoyrecreationalassets: Achieve water quality at main recreational beaches: percentage of days that monitored beaches are suitable for recreational use during bathing season – 1 December to 31 March

WewanttoensureourCityhas asafe,reliable,qualitystormwatersystem:

flooding events

Median response time to attend a flooding event, measured from the time the territorial authority receives notification to the time service personnel reach the site

Compliance with resource consents for discharges from stormwater system (number of abatement notices, infringement notices, enforcement orders, and convictions

Capital Projects - Stormwater

ProspectiveStatement of ComprehensiveRevenueand Expense

Explanations of differences between the10Year Plan 2024-2034 and the equivalent years of theAnnual Plan 2023-24 - Stormwater

Revenue - Stormwater

Revenue has increased by $19 million largely due to changes to the assumed development contributions recovery aligned to the proposed capital programme and Development and Financial Contributions policy.

Expenditure- Stormwater

Expenditure has increased by $28 million and is driven by higher operating cost budgets for maintenance and operations as per Wellington Water Limited advice as well as higher interest and depreciation costs linked to the increased capital investment.

Capital - Stormwater

Capital expenditure has increased by $113 million based on the higher investment as advised by Wellington Water Limited. Some key changes are to funding allocations for projects to deal with flooding (partly driven by growth), as well as additional allocations for renewal projects.

Para | Solid waste

Statements of ServicePerformance

What wedo

Council’s role in solid waste management is important for keeping the community healthy, ensuring a high-quality of life, and supporting a thriving environment.

The solid waste activity delivers on Council’s waste management objectives, by:

• operating Council’s kerbside rubbish, recycling and green waste collection service;

• operating Silverstream landfill;

• monitoring and managing all of Council’s closed landfills; and

• investigating, trialling and/or implementing new initiatives to reduce waste.

Over the next 10 years, Council is working to improve our waste minimisation by partnering with other councils in the region to implement a Food and Green Organic collection service.

Why wedo it

Solid waste management is integral to maintaining a healthy, vibrant community. By actively participating in waste management, we directly contribute to the overall wellbeing of our residents and the preservation of the environment.

Our commitment to waste minimisation reflects our dedication to creating a sustainable and eco-friendly community. Through the ownership and operation of the Silverstream Landfill, we take a comprehensive approach to managing solid waste.

Significant negativeeffects and mitigation

The potential environmental impacts resulting from non-compliance with resource consent conditions are managed through our management strategies and adherence to best practices. Inadequate recycling and refuse collection

services might result in increased littering. While certain sustainability initiatives, like waste reduction and modern waste management practices, may appear costly, time consuming, and restrictive to some, these effects are alleviated by collaborating with communities to establish mutually agreed upon sustainability approaches.

Key PerformanceIndicators

Weareworkingtominimisetheharmfuleffectsofrefuse:

notices received from Greater Wellington Regional Council

Wewanttoreducelitterandthenegativeimpactsitcanhaveonournaturalenvironmentandon ourcommunity’shealth:

Wearelookingatwaystoreducetheamountofwastegoingtolandfill:

ProspectiveStatement of ComprehensiveRevenueand Expense - Solid waste

Explanationsof differences between the 10 YearPlan 2024-2034 and the equivalent years of the Annual Plan 2023-24 - Solidwaste

Revenue - Solidwaste

Revenue has decreased by $9 million largely due to anticipated waste diversion activities at the Silverstream Landfill which is expected to reduce the volume of waste received in the future.

Expenditure - Solidwaste

Expenditure has increased by $43 million, driven by higher operating cost budgets for the kerbside collection services including introduction of the new Food and Green Organics collection service proposed to start 1 July 2027. This is offset by higher targeted rates funding included under the Corporate Services activity.

Capital - Solidwaste

Capital expenditure has increased by $15 million based on the roll out costs and joint investment into a processing plant for the new Food and Green Organics collection service proposed to start 1 July 2027.

Whakauka me te Manawaroa |

Sustainability and resilience

Statements of ServicePerformance

What wedo

The climate change and sustainability activity is focused on changing the way we do things to improve climate outcomes across Council and for the community. This includes delivering on our Carbon Reduction Plan 2021-31 and the Lower Hutt Climate Action Pathway.

The climate change activity delivers on Council’s climate change objectives, by:

• providing advice to Council on climate change-related projects (such as the setting up of a Green Star requirement for the new Naenae pool);

• managing and supporting projects to implement carbon reductions in line with Council’s Carbon Reduction Plan 2021-31 and the Lower Hutt Climate Action Pathway (such as the EV charging station roll out);

• delivering the Low Carbon Acceleration fund to support the city to reduce its emissions faster;

• managing and supporting regional projects, in collaboration with neighbouring Councils (including the Regional Climate Change Impact and Risk Assessment, Regional Adaptation Plan and Regional Emissions Reduction Plan; and

• monitoring Council’s carbon emissions (annual carbon footprint).

Why wedo it

In order for Council’s climate change actions to be meaningful, the Council, and communities in Te Awa Kairangi ki Tai Lower Hutt, must ultimately align with good practice.

The sustainability and resilience activities enable the delivery of emission reductions, in line with Council’s organisational zero by 2050 carbon target.

Significant negativeeffects and mitigation

Emergency response and recovery efforts can temporarily impact community and environmental well-being as social systems and infrastructure are reconstructed after an emergency. A poorly executed emergency management response can lead to severe and lasting negative effects on overall well-being.

Key PerformanceIndicators

Sustainabilityandresilience

PerformanceMeasure Reporting frequency Target2024-25 Target2024-34

Councilisrespondingtotheimpactofchangeinclimateand contributingtothegoalof acarbon zerocityby2050

Emissions from Councilowned facilities (tCO2-e)

Emissions from Councilowned fossil fuel vehicles (tCO2-e)

Quarterly 30% reduction by 2024 50% reduction by 2030

Quarterly 30% reduction by 2024 Zero emissions by 2030

Ourcityispreparedforanemergencyandcanrespondappropriately: EOC resourcing levels maintained at least at WREMO competency level targets:

Annual Advanced - 6, Intermediate - 12 Foundation - 12

There are no capital projects associated with this activity.

Controller -6 Advanced - 18, Intermediate - 16 Foundation - 50

ProspectiveStatement of ComprehensiveRevenueand ExpenseSustainability and resilience

Explanations of differences between the10-year plan 2024-2034 and the equivalent years of the Annual Plan 2023-24 - Sustainability and resilience

Revenue - Sustainability and resilience

Revenue has increased by $5 million largely due to the waste minimisation levy recovery based on assumed volume of waste.

Expenditure- Sustainability and resilience

Expenditure has increased by $10 million. This is partly linked to the higher waste minimisation levy which is ringfenced and allocated to specific activities in alignment with the Waste Management and Minimisation Plan. There is also additional budget allocated through this plan for emergency management activities, a large portion of which is contracted costs.

Ngā Ratonga Waeture | Regulatory services

Statements of ServicePerformance

What wedo

Our statutory activities are essential for cultivating a clean, healthy, appealing, safe, and sustainable environment for residents and visitors. These activities encompass building and resource consents, environmental health, trade waste management, animal services, and parking control. We are currently implementing new systems and processes to improve the customer experience and speed of our consent processing. For example, our new customer portal “Objective Build” and new processing software “Go Get” will help streamline consenting processes in the future.

We ensure the safety of the community by inspecting various establishments to guarantee cleanliness and hygienic practices. This reduces the risk of foodborne illnesses and alcohol-related harm.

Additionally, we oversee health-related activities in industries such as tattoo studios and beauty therapy shops to mitigate potential health hazards.

We also address health nuisances and noise issues to maintain a healthy living environment for everyone.

Why wedo it

Most of our functions are required through various pieces of legislation. While primarily focused on environmental wellbeing, these activities also contribute directly to economic, social, and community safety outcomes. They play a crucial role in establishing and maintaining standards, promoting health and safety, and ensuring the welfare of our community. They are also aligning with our commitment to a vibrant and secure city.

Our activities aim to protect public health and the environment. Through the trade waste function, we manage wastewater and chemical hazards, responding promptly to water pollution incidents. By registering commercial properties that discharge liquid waste and charging users accordingly, we

cover the expenses associated with waste treatment and disposal and ensure the safety of our waterways and surroundings.

Our animal services activities focus on enforcing regulations to ensure the safety of residents and the welfare of animals.

Finally , our parking services promote safe and efficient parking, ensuring fair access to public car parking spaces and enhance overall traffic management in the city.

Significant negativeeffects and mitigation

The necessity for regulatory measures benefiting the broader community can sometimes diminish perceptions of personal freedom. These regulations may be viewed as obstacles leading to costs and delays.

Key PerformanceIndicators

RegulatoryServices

Weneedtoensurethatnewhousingissafeandmeets standards withoutdelayingtheprocess:

Wewant a

whereeveryonefeels

Capital Projects Regulatory Services- Regulatory Services

There are no capital projects associated with this activity.

ProspectiveStatement of ComprehensiveRevenueand Expense - Regulatory Services

Explanations of differences between the10-year plan 2024-2034 and the equivalent years of theAnnual Plan 2023-24 – Regulatory Services

Revenue - Regulatory Services

Revenue has increased by $16.5 million largely due to increases to fees and charges to help offset cost increases in this activity.

Expenditure- Regulatory Services

Expenditure has increased by $32 million and is driven by additional resourcing cost put in place to deal with the demands across this activity.

Oranga Ōhanga - Economic Wellbeing

Introduction to Economic Wellbeing Section

A thriving economy is essential for the wellbeing of our people. A strong and sustainable economy provides better job opportunities, higher wages, and a higher living standard for residents. It also builds business confidence, provides commercial opportunities and attracts more investment into the city.

We take a partnership approach to growing the city’s sustainable economic success, building capability within our community and making it easy to do business in Te Awa Kairangi ki Tai Lower Hutt.

Taking the next steps in our work work for the next 10 years involves enhancing our engagement with Māori and Pasifika business communities, supporting partnerships to grow our workforce to meet our infrastructure needs and cement our competitive advantage in the science, technology, manufacturing and innovation sectors.

We will facilitate a circular economy through zero waste and zero carbon initiatives and developing capability. To explain a little more, a circular economy is an economic system that aims to minimise waste and maximise the efficient use of resources. It also looks to regenerate nature and reduce the environmental impact of our activity.

We will celebrate our city’s identity and promoting Lower Hutt, it’s people and businesses to attract investment, spending, and tourism that delivers an effective circular economy.

Economic Wellbeing Dashboard

Infographics [dashboard details to be confirmed and updated]

GDP (Sep 2023)

$7,580M (Infometrics)

Consumer Spending (Sep 2023)

$1,684M (Infometrics)

Income Median annual individual income

$34,700 (Census 2018)

Annual individual income by income group (census 2018)

$20,000 or less – 32%

$20,001 - $40,000 – 23%

$40,001 - $60,000 – 18%

$60,001 - $100,000 – 17%

$100,001 - $150,000 – 6%

$150,001 or more – 3%

Unemployment rate (Sep 2023)

2.80% (Infometrics)`

NEET rate (Year end March 2023)

5.2% (15-19 year olds) (Stats NZ)

10.3% (20-24 year olds) (Stats NZ)

Number of Jobseeker supplement recipients (Sep 2023)

4,133 (Infometrics)

Number of businesses (Sep 2023)

11,143 (Infometrics)

Communication Access (Census 2018)

Access to cell phone /mobile phone 93% (Census 2018)

Access to internet 87% (Census 2018)

No access to telecommunication systems 1% (Census 2018)

Average house value (Sep 2023)

$757,669 (Infometrics)

Average rent (Sep 2023)

$550 (Tenancy Services)

Housing Affordability (average house value to average household income – Sep 2023)

5.5 (Infometrics)

Rental Affordability (average rent to average household income Sep 2023)

28% (Homes.co.nz and Stats NZ via Dot Loves Data)

Number of households on Housing Register (Sep 2023)

564 (Ministry of Social Development)

Ability to cover every day needs

43% not enough or just enough (Quality of Life 2022)

53% enough or more than enough (Quality of Life 2022)

Stories for Economic Wellbeing

Whiria temuka tangata, whārikihia te Kaupapa | Council’s Integrated Transport Strategy

A great transport system connects our communities, provides access to social opportunities, and helps grow our economy. But like other cities, Te Awa Kairangi Lower Hutt facing some big challenges, including a fast-growing population, higher costs and a changing climate.

The Integrated Transport Strategy outlines Council’s vision, and strategic direction for responding to the city’s growing transport challenges. It lays out an integrated approach to delivering land use planning, transport planning, investment and encouraging behaviour change within Te Awa Kairangi Lower Hutt.

The Strategy is now guiding Council’s decision making about changes to the transport system to address the challenges our communities are facing. We’re now developing a plan under each of the seven Strategy focus areas, along with key targets and measures. A range of measures will be used to indicate whether the direction of change is in keeping with the vision of this Strategy, including mode shift, journey times, carbon emissions, health-related measures, economic growth, safety trends, and resident satisfaction.

You can find more information about Council’s Integrated Transport Strategy here - Link

Ngā waka | Transport

Statements of ServicePerformance

What wedo

The Transport team oversees essential programs aimed at maintaining, operating, and enhancing our transport system, and a continuous improvement approach for infrastructure development. Our focus prioritises road safety, encourages mode-shift in transport choice, improved travel options, with a specific emphasis on mitigating climate change and delivery of infrastructure projects in a timely manner. Our goal is to have a wellconnected and modern transport system that accommodates all modes of transportation and ensures accessibility and connectivity throughout the city. Why wedo it

Our commitment is to future-proofing our growing city for future generations. We strive to establish a resilient and interconnected transport system that offers increased accessibility and encourages alternative modes of transport (for example Tupua Horo Nuku). Our efforts in road and traffic asset management, maintenance contracts, road safety services, and active modes aim to provide well-maintained roads, footpaths, and streetlights. This infrastructure facilitates efficient and secure travel for motor vehicles, bicycles, and pedestrians, aligning with our vision of a vibrant and connected city. We are also investing in projects to improve the resilience of our networks in the face of a changing climate. A good example is the work on Eastern Hutt Road which, when finished, will improve the reliability of the road to Council’s Northern suburbs.

Significant negativeeffects and mitigation

The possible environmental impacts of increasing transportation demand include various forms of pollution such as increased water runoff contamination from roads, emissions of particulates from heavy road vehicles, air pollutants

from road traffic, as well as traffic noise and vibrations. Additionally, congestion on vital routes, the loss of productive and recreational land for transportation infrastructure, and public health risks associated with traffic accidents are concerns. Transport planning takes into account these adverse effects and includes measures to address them. Efforts are made to reduce crashes through studies and necessary interventions in high-crash areas. Works are carried out annually to minimise traffic delays and consequently reduce air pollution. Furthermore, alternative modes of transportation are actively promoted.

Key PerformanceIndicators

Transport

Weneedtobeabletotravelalongkeyroutesefficiently:

Road condition index which measures the condition of the road surface

The average quality of ride on a sealed local road network, measured by smooth travel exposure

sealed local road network that is resurfaced annually

Percentage

footpaths that fall within the service standard for footpath condition

Percentage of customer service requests relating to roads and footpaths that are responded to within the statutory timeframe

Kilometres of shared pathways and cycle lanes added annually.

Kilometres of renewals for footpaths

Weareworkingtostrengthenouractivetransportnetwork: Resident satisfaction with the footpath condition

Resident satisfaction with on road cycleway condition

Resident satisfaction with shared path condition Annual ≥ 80% ≥ 80%

Resident satisfaction with the availability of car parking to access services and facilities (does not include access to residences)

Roadsafetyservices:

The number of fatalities and serious injury crashes on the local road network

Annual ≥75% ≥75%

Quarterly Previous year less 1% Previous year less 1% Capital

ProspectiveStatement of ComprehensiveRevenueand Expense – Transport

Explanations of differences between the10-year plan 2024-2034 and the equivalent years of theAnnual Plan 2023-24 - Transport

Revenue - Transport

Revenue has increased by $89 million largely due to proposed parking fee changes, increases in capital/operating subsidies and grants linked to higher costs, and development contributions revenue linked to planned projects driven by growth.

Expenditure- Transport

Expenditure has increased by $93 million, driven by higher operating cost budgets for a range of renewed contracts for maintenance activities, additional resourcing put in place and higher depreciation costs linked to the increased capital investment.

Capital - Transport