We base your rates bill on your property value. Under the law, we need to update our record of property values in Lower Hutt every three years; we last did this in 2022.

A quick guide to revaluation

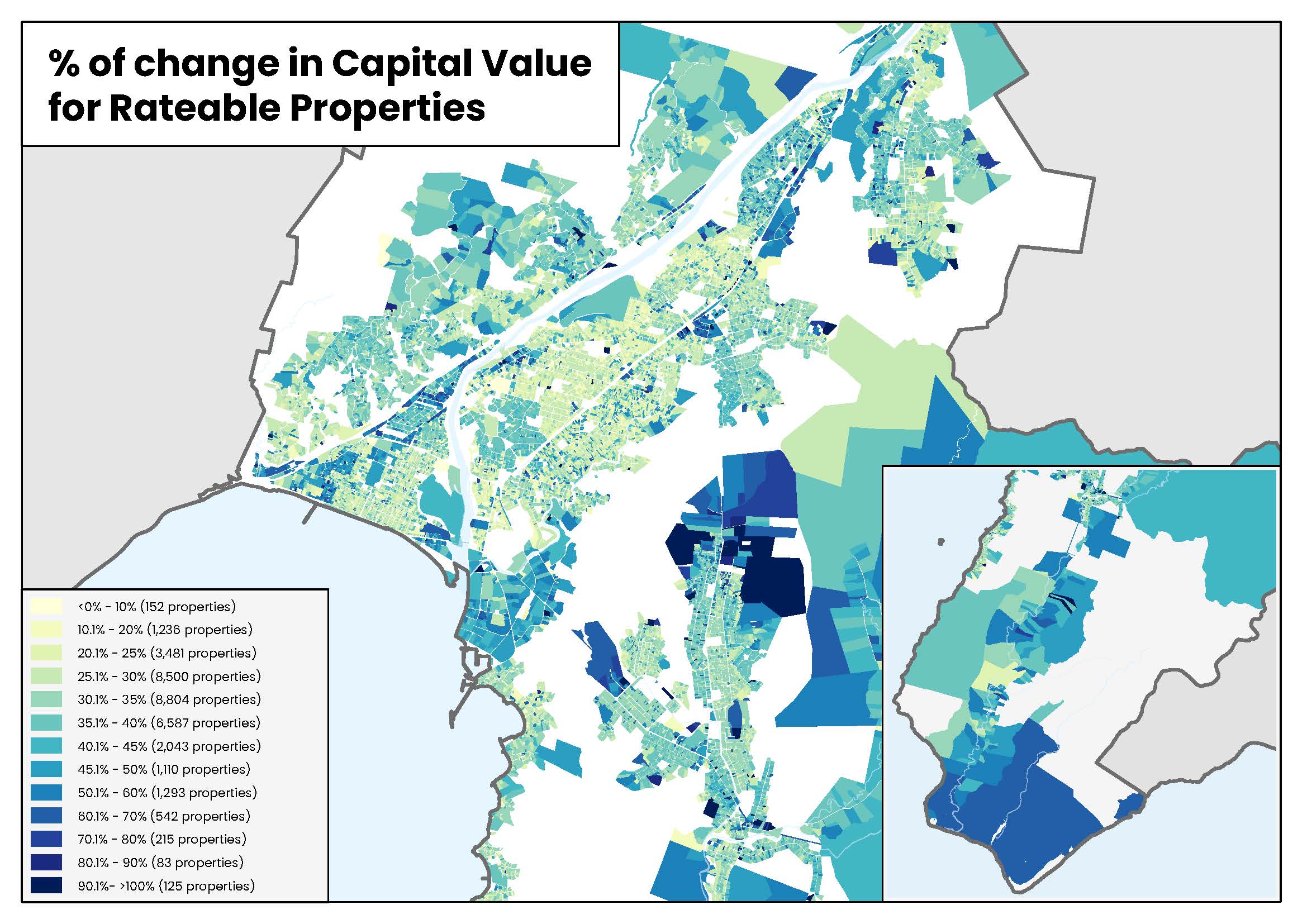

How revaluation looks across the city

Take a look at how property values have changed across the city since 2019 with our interactive map

Frequently asked questions

Valuations are made up of:

Capital value: the approximate price that would be paid for the property at the valuation date. It’s the total of the land value and improvements value, the total value of your property. It excludes chattels, stock, crops, machinery or trees. Residential values include GST, other property types do not.

Land value: the approximate price that would be paid for the bare land. It includes work such as drainage and excavation.

Improvement value: is calculated by subtracting the land value from the capital value. It represents the extra value the buildings and other improvements (eg, landscaping and fencing) add to the land. It doesn't indicate the actual cost of building or landscaping.

QV analyses all property sales that occurred in your area to identify market trends, and then apply those trends to similar properties (e.g. residential values are based on residential sales, commercial values are based commercial sales).

Some properties are inspected throughout the year to make sure details are updated where changes have occurred; QV is notified about changes as part of the building consent process.

The updated property values are also independently audited by the Valuer-General.

An increase in your property value may not mean you pay more in rates – it all depends on how your property’s value changes, compared to the average property value change across the city.

Revaluation helps us work out everyone’s share of rates, but it doesn’t increase the total amount of rates that Hutt City Council collects.

If the capital value of your property has gone up more than the average, then your share of the general rate will go up by more than the average rates increase. If your property’s value has increased less than the average, then your share will go up by less than the average rates increase. This can be a bit complicated – check out the video at the top of this page for more explanation.

It’s important to note that any changes to rates are set through the Annual Plan, and this will also impact your rates bill from 1 July 2023.

Valuations are a snapshot of the market as at 1 September in the year of revaluation. The law requires us to complete a revaluation every three years; the last time we did this was in 2022.

Your updated property value is used to calculate your rates bill in the next financial year. In 2022, we updated your property value based on what we estimated your property would have sold for on 1 September 2022. The updated property value will be used to calculate your rates bill from 1 July 2023.

Quotable Value (QV), an independent valuation service, undertakes valuations and sets values on behalf of Hutt City Council every three years. Councils across the country records details such as floor and land area, building age, condition, and location on every property in New Zealand.

Councils store details on every property in New Zealand, including yours. Properties with similar features such as land area, and age of building, condition and location are grouped together. Sales data is then used to calculate a trend for properties like yours, which will be applied to the group in which your property sits.

Before revaluation (and also throughout the three years between revaluations), QV carry out a number of internal and roadside inspections to gather additional data. For example, if you are issued a building consent for work to your property, QV will generally complete an internal or roadside inspection.

The objection period closed on 31 January 2023. If you disagree with your valuation, contact Quotable Value (QV) online or over the phone on 0800 786 822.

| Residential | 31.2% |

| Commercial | 30.6% |

| Industrial | 50.5% |

| Farming | 49.0% |

| Lifestyle | 41.8% |

| Forestry | 31.5% |

| Utilities | 25.2% |

| Other | 34.1% |

| Average change across all property types | 32.7% |

If you’d like to read more about revaluation in NZ, head to QV’s website

At a very basic level, there are three steps:

Step 1: Council works out how much income is needed from rates in order to run the city.

Step 2: Some rates are for specific things such as water supply. These are called targeted rates and are not calculated using the capital value method.

Step 3: The general rate is collected to fund things that benefit everyone, like roads and parks maintenance. This is where capital value comes in – the total general rate amount is spread across the city according to capital value.

Each property is placed in a rating category, based on land use and location. A charge is set for each rating category to calculate the general rate: the charge is a number of cents per dollar of capital value. Different categories of property pay different amounts of rates.

For full details of how rates are calculated see the funding impact statement including rates for 2022-23

You can find all Lower Hutt’s rating information on our property enquiry system

This includes full information about a property, including how it's rated. This doesn’t include the name or postal address of the owner. To access these details you'll need to come in to our office and request the information in person.

The Local Government (Rating) Act allows these details to be made available to the public, unless there's been a specific request to withhold them.

If you'd like your name and postal address to be withheld from our public rating information, you'll need to make a request in writing, providing details for each property concerned. You can change this back at any time by writing to us.

Things to note are:

- In cases where a request to withhold is made, and there's more than one owner of the property, all owner information will be withheld

- Withholding details will still be publicly available as part of a property’s Record of Title Information, which is available through Land Information New Zealand

We collect rates on behalf of the Greater Wellington Regional Council (GWRC). You can find out more about these on the GWRC website

You might be eligible for a rates rebate, postponement of your rates, or we can work with you to set up a rates payment plan. Please get in touch with Council if you’re facing financial hardship – we’re here to help. You can find more information here, including how to get in touch with us about rates support.